Overview of the development of the global PCB industry

The PCB industry is the industry with the largest output value in the global electronic component industry, and it is also the basic industry for the manufacture of electronic information products. In 2019, affected by multiple factors, the output value of the global PCB industry fell slightly by 1.7% year-on-year to US$61.3 billion.

Although the COVID-19 in 2020 will have an impact on the industry, the rapid development of 5G has allowed the PCB industry to continue to expand. It is estimated that the global PCB output value will be 62.5 billion US dollars in 2020 and reach 79.2 billion US dollars by 2025.

The Printed Circuit Board (PCB) industry is the basic industry of electronic information product manufacturing, and it is also the industry with the largest output value in the global electronic component industry. PCB has a wide range of applications, ranging from home appliances to products such as detecting the ocean. As long as there are electronic components, PCBs are used for the support and interconnection between them.

1. The output value of the global PCB industry declined slightly in 2019

Affected by trade frictions, declining terminal demand and exchange rate depreciation, the global PCB output value was US$61.3 billion, a slight decline of 1.7% from US$62.4 billion in 2018. Mobile phones are the most important application outlet for PCBs. With the decline in mobile phone shipments for three consecutive years, the decline in the overall global PCB output value can still be maintained within a small range. The pre-5G infrastructure is also a key issue. Part of the PCB demand was returned.

2. China’s PCB market performs better than other regions

From the perspective of regional markets, the Chinese market performed better than other regions. In 2019, the output value of China’s PCB industry was about 32.9 billion US dollars, a slight increase of 0.7%, and the global share was about 53.7%. It is the only growth region in 2019. This is mainly due to the high growth of related circuit board suppliers by 5G base stations. .

In 2019, although the Sino-US trade war initiated a boycott of Huawei, with the current attitude of countries around the world adopting Huawei equipment, Huawei’s market share in the 5G era still has room for growth. With the rapid development of industries such as 5G, big data, cloud computing, artificial intelligence, and the Internet of Things, as well as industrial supporting and cost advantages, the market share of China’s PCB industry will continue to increase.

In addition, the total output value of circuit boards in Japan in 2019 was approximately US$5.288 billion, a year-on-year decline of 2.8%, accounting for 8.6% of the global market. From the perspective of the product layout of the Japanese circuit board industry, in order to avoid the fierce competition in mobile phone applications, Japanese FPC companies have adopted the strategy of moving mobile phones to new applications such as automobiles, robots, and biomedicine. What are the results? It remains to be seen.

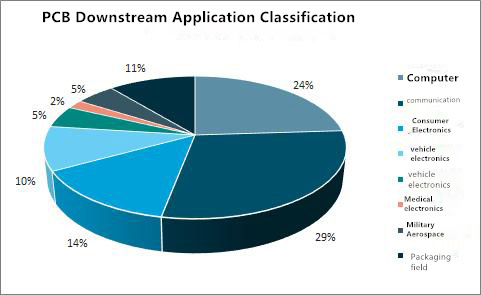

3. Communication electronics is the main application field

From the perspective of application fields, most PCB market segments also experienced a decline in 2019, but the demand for infrastructure applications such as 5G networks and data centers continued the growth trend in 2018, with the output value of the server/data storage field year-on-year An increase of 3.1%; the computer field including servers/data storage accounted for 28.6% of the global PCB output value. But overall, communication electronics is still the most important application field in the PCB industry, accounting for 33.0% of the global PCB application market in 2019.

4. Seven major Chinese manufacturers are on the global TOP10 list

The growth of downstream industries is a major favorable condition for the development of PCB companies. Benefiting from the important position of Taiwanese ODM/EMS factories, module factories, and semiconductor companies in the PC and mobile phone industry chain, Taiwanese PCB companies such as Zhending, Xinxing, Huatong, and Tripod have successively entered the world’s top ten PCB manufacturers list . Among them, FPC giant Zhending, which is closely related to Apple’s business, became the world’s number one PCB manufacturer in 2019. In general, among the TOP10 global PCB manufacturers in 2019, 7 Chinese companies are on the list, and China is the world’s largest PCB producer.

5. It is estimated that the output value of the global PCB industry will be close to 80 billion U.S. dollars in 2025

Entering 2020, although the new crown pneumonia epidemic disrupted the progress of 5G, countries are still fighting each other in the 5G competition. While the epidemic is burning, countries have used digital technology to monitor the development of the epidemic, and have foreseen the turning point of industries such as 5G, cloud and AI. Future digital life scenarios such as remote teaching, smart diagnosis and treatment, and industrial risk control AI have also been activated in advance.

In terms of the overall development trend in 2020, 5G is still a key driving force for the growth of the industrial economy. It is estimated that the global PCB output value growth rate in 2020 will be 2%, and the output value scale will be approximately 62.5 billion US dollars. From 2020 to 2025, the global PCB output value is expected to grow at an average annual compound growth rate of about 5%. In 2025, the global PCB output value is expected to be close to US$80 billion.