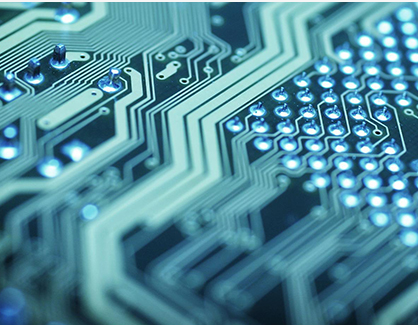

The development of the downstream PCB industry promotes the growth of PCB ink demand:

In recent years, the manufacturing industry led by the electronic information industry has shifted to the Asia-Pacific region. The global PCB manufacturing center has grown rapidly in the Asia-Pacific region. China’s PCB output value has increased significantly, and China’s PCB industry status has continued to strengthen. According to data from the China Business Industry Research Institute, China’s PCB output value has reached 32.9 billion yuan in 2019, and will further rise to 35.1 billion yuan in 2020.

As the cutting-edge basic material of the PCB industry, PCB inks continue to expand in downstream applications, covering multiple industries such as automotive electronics, computers, information communications, aerospace, household appliances, energy-saving lighting, consumer electronics, and industrial control. With the acceleration of product upgrades in the electronic information industry, the market’s requirements for the improvement of electronic product performance have also continued to increase, PCB ink technology has been rapidly updated and upgraded, and the market scale has continued to grow. According to public data, the demand for PCB ink in China in 2018 was 14,000 tons, and it is expected that by 2022, the demand for PCB ink in China will rapidly increase to 16,880 tons, with a compound annual growth rate of 4.79%. The scale of domestic PCB ink demand Steady growth.

With the advancement of 5G technology and Internet of Things technology, categories of electronic terminals are increasingly diversified. The rise of electronic terminals such as smart logistics, smart wear and smart home will exert a strong pulling effect on the demand for PCB ink and promote the growth of PCB ink industry.

The special coating industry is growing steadily, and the market potential of new environmental protection coatings is huge:

The development of special electronic coating industry is closely related to the development of downstream application fields. The deepening and broadening of downstream application fields, the rapid growth of domestic terminal brand business, the localization of supply chain, the transfer of manufacturing focus to China and other factors drive the rapid development of domestic special electronic coating industry. As the largest market segment in the field of special coatings, electronic coatings are the shell coatings used in electronic commodities, mainly used in three categories of products such as computers, mobile phones and household appliances. In 2019, the total value of the global electronic coating market reached 8.1 billion yuan, of which China’s market share accounted for 60%. It is estimated that by 2026, the total value of the global electronic coating market will reach 10 billion yuan, with a compound annual growth rate of 3.0%.

At the same time, in recent years, the electronic chemical industry has developed in the direction of green, energy saving and environmental protection. The new environmental protection coatings represented by UV curing coatings have ushered in greater market opportunities. In the early stage, UV curing coatings were mainly used in the coating field of electronic products such as CD, DVD and Walkman. With the continuous progress of technology, their application fields gradually expanded to TV, computer, optical fiber and other products. At this stage, they are also widely used in medical devices, automobiles, wood, plastic products, metal products, paper, fabric, glass, building materials, food packaging, beverage packaging Cosmetics packaging and other industries. UV curable coatings have excellent physical and chemical properties, good coating effect, fast curing speed and low pollution. They have become one of the main alternative products of traditional solvent based coatings. They are known as “green coatings and environment-friendly coatings in the 21st century”. They have great market potential in the future.

China’s photoresist industry is booming, and the market prospect can be expected:

Driven by a series of national dividend policies, the domestic semiconductor, flat panel display and PCB industries have a good development momentum. As a key material in the manufacturing process of semiconductor, flat panel display and PCB industries, the market demand for photoresist has been rapidly released, especially the photoresist output for flat panel display has increased, and the photoresist output in China has shown a steady upward trend. According to the data of toubao Research Institute, China’s photoresist output increased from 63000 tons in 2014 to 90000 tons in 2018 (CAGR is 9.3%), and it is expected that China’s photoresist output is expected to reach 238000 tons by 2023 (CAGR is 21.56% in four years).

Benefiting from the support of the national dividend policy, Chinese local photoresist manufacturers actively improve the technical level and R & D capacity of photoresist products, and promote the process of photoresist localization. In the future, China is expected to break through the technical barriers of high-end photoresist products and further improve China’s photoresist production.

At the same time, the global semiconductor industry, flat panel display and PCB industry are gradually transferred to China, driving the surge in the demand for photoresist in China. China’s photoresist industry has great development space. China Internet plus and China made continued development of the industry. The demand for photoresist in the downstream application terminal industry is expected to continue to grow, thus promoting the production of China’s photoresist. It is estimated that by 2023, China’s photoresist output will reach 238 thousand tons, and the market will have broad space for development.

May. 18, 2021

May. 18, 2021